New Home Sales on the Wane in the OC

Corelogic recently reported that new home sales in Orange County experienced an unbroken downward streak from November 2014 through September 2015. This downward trend runs counter to what has been happening nationally and in other parts of Southern California. While OC housing bulls might point to a lack of available supply as a reason for lower sales figures, the bears would point to less housing market participation on the part of Chinese buyers and runaway pricing as reasons why sales have dropped to lower levels.

About author

You might also like

Luxury Home Sales in U.S. Continue to Rise

Sales of luxury homes in most parts of the U.S. have continued to increase over the last year, according to an analysis of more than 40 high-end counties in 16 states, despite concerns from some analysts about a slowdown.

Is The Housing Recovery Over?

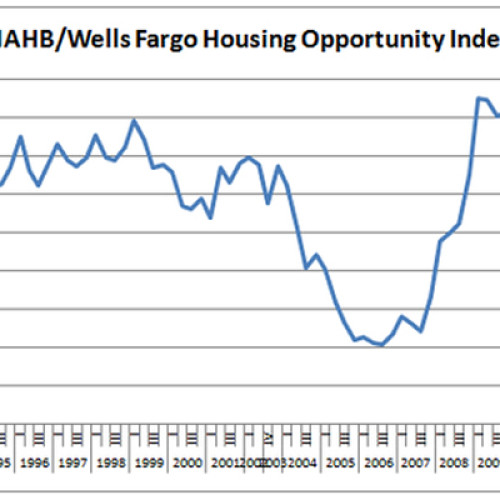

There is currently much debate on the direction of the housing market. Did we bounce back off the bottom too fast? What inning are we in? 3rd? 6th? While there

New Home Sales Slide

On the heels of earnings misses from DR Horton and PulteGroup, the US Commerce Department reported more disappointing news for the new home market. Sales for new single-family homes dropped