Easing Mortgage Standards

Mortgage standards appear to be loosening in what will be a critical factor in aiding the housing recovery. After a period of tight standards in the wake of the housing bust, lenders, with assistance from the government, are easing credit for homebuyers. Among some of the positive changes are an increase in low downpayment programs and lower minimum credit scores.

About author

You might also like

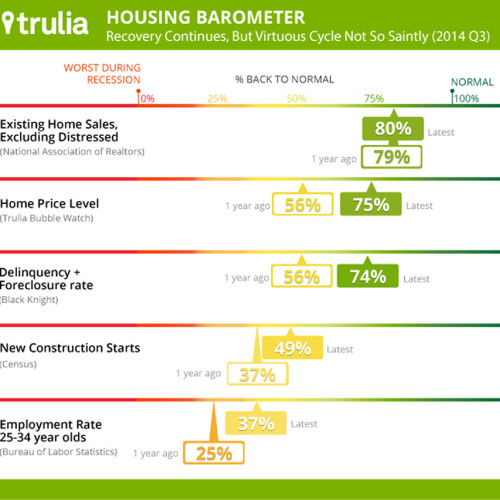

Status of Recovery?

In this snapshot of where we are on the road towards a “normalized” housing market, Trulia chief economist Jed Kolko examines five key factors that impact the market. Bottom line

Renewed Life in the Inland Empire

Signs of renewed life in the Inland Empire? Despite the optimistic slant of this article, word on the street still seems to be that housing activity is sluggish in inland

Pull Back in Housing Starts but Rise in Permit Activity

Starts dropped in May by 11% from April and came in at an annualized rate of 1.04 million units. The April starts figure was a seven-year high. Despite the drop,