Hand-Wringing Over Rising Rates

Builder Online

By John McManus

Are rising interest rates eroding demand momentum? It’s really tough to do the math, because cause-and-effect doesn’t come purely into play, and even correlations are hard to prove, because multiple variables always work as forces. As Wells Fargo analyst Steve East puts it, as interest rates go up as they’re going to do, what happens to demand is virtually a no-win for the public builders. Either way they get hit with negative investor sentiment.

About author

You might also like

Slight Slowdown in Sales but Continued Stability in California Housing Market

Existing home sales softened in May to 423,360 units from 427,880 in April. Nevertheless, the May number was 8.9% above the figure from May 2014 and represented the second highest

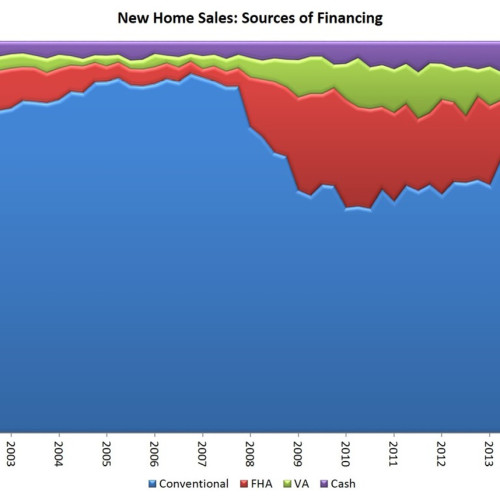

Conventional Financing Gains Ground

In another sign of the increasing health of the housing market, the share of mortgage financing made through conventional loans continues to expand. In 2011, at a low point, the

New-Home Sales Up for Fifth Straight Year

By Frank Nothaft Low mortgage rates, job growth, and an improving consumer optimism have all supported the recovery in home sales during the last few years. Both sales of newly