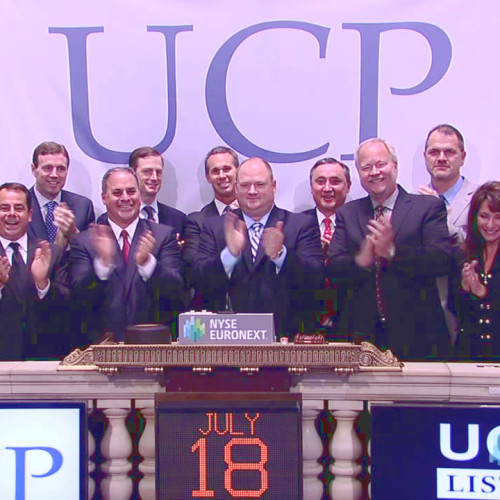

Small Cap Homebuilder UCP Positioned for Buyout

In this article by Seeking Alpha, the contention is made that the landholdings of the publicly-traded homebuilder, UCP, the bulk of which was acquired in the downturn, is being carried on their balance sheet at a discount to current value. Hence, as the stock price is trading close to book value, for larger builders seeking to gain entry into the primarily West Coast markets in which UCP operates or augment their West Coast positions, the company might make an attractive buyout candidate.

About author

You might also like

Toll Reports $70 Million Profit

Toll Brothers, Inc., Horsham, Pa. (NYSE:TOL) on Wednesday reported net income of $70.4 million, or $0.42 per share, for its first fiscal quarter ended Jan. 31, compared to net income

Beazer Misses Big for Fiscal 1Q 2015

For fiscal 1Q 2015, Beazer reported earnings of ($0.68) per share versus the consensus analyst estimate of ($0.16) for a miss of $0.52. Revenue was $265.8M for the quarter against

New Homebuilding Publics

Among the cohort of new, publicly-traded homebuilders this cycle are UCP and Century Communities. In this Builder Magazine article, a deeper look is taken into the origins and philosophies of

0 Comments

No Comments Yet!

You can be first to comment this post!