Land Financing 101

Mark Strauss, Managing Director with Cohen Financial, discusses the nuances of land loans. Due to its illiquid nature and lack of cashflow, lenders are generally hesitant to lend on land assets. If they do, there is a preference for infill versus greenfield and entitled land where the borrower is implementing a business plan that entails build-out of the asset. LTVs tend to stay low – in the 50% to 60% range – with banks charging 4% to 6% interest rates and private money lenders charging 8% to 14%.

About author

You might also like

Industrial Park to Make Way for Condo Complex in Old Town Tustin

Newport Beach builder Taylor Morrison Home Corp. is expected to break ground on the 140-unit Vintage Lofts condominium complex at the 7-acre industrial park in February of 2018

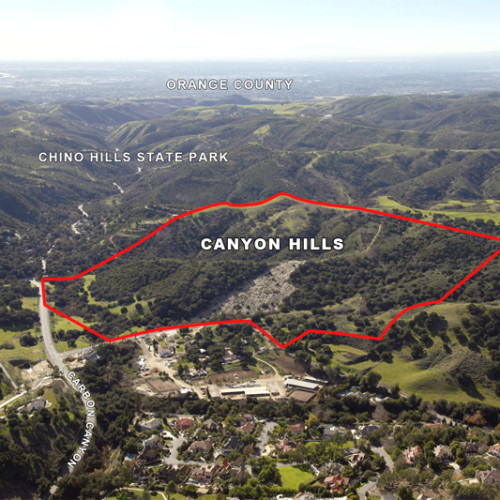

Woodbridge Pacific Closes on 76 Lot Canyon Hills Project in Chino Hills

Foremost Communities sells Canyon Hills to Woodbridge Pacific, a private homebuilder based out of Mission Viejo. The project, located in the highly desirable Inland Empire market of Chino Hills, will

Mothballed Riverside Mega-Project Comes Back to Life

Spring Mountain Ranch, in the City of Riverside, a 1400-unit mothballed housing development begun during the last housing cycle, sees renewed activity with KB Homes, in a joint venture with