Homeowners Have More in Equity, But Mood Soured by Rising Mortgage Rates

Home prices have been rising for 53 straight months, lifting millions of borrowers from underwater on mortgages.

In the first three quarters of 2016 alone, howeowners added $837 billion in total equity.

But apparently those gains are not enough to counter the negative effects of rising mortgage rates.

About author

You might also like

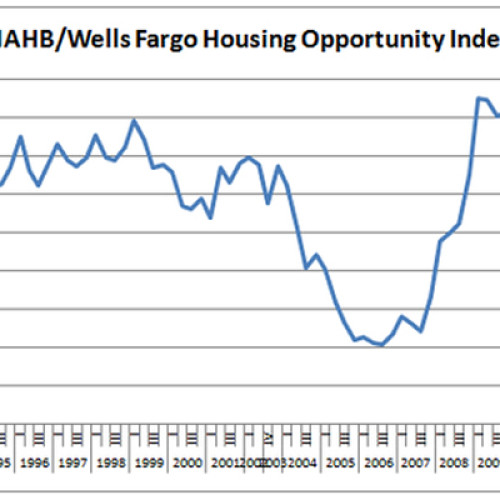

Is The Housing Recovery Over?

There is currently much debate on the direction of the housing market. Did we bounce back off the bottom too fast? What inning are we in? 3rd? 6th? While there

Homebuilder Optimism Looking Up

The NAHB Builder Confidence Index rose 4 points in April to 56. This was the first rise in five months although the index had never dropped below 50 during this

Luxury Home Sales in U.S. Continue to Rise

Sales of luxury homes in most parts of the U.S. have continued to increase over the last year, according to an analysis of more than 40 high-end counties in 16 states, despite concerns from some analysts about a slowdown.