Homeowners Have More in Equity, But Mood Soured by Rising Mortgage Rates

Home prices have been rising for 53 straight months, lifting millions of borrowers from underwater on mortgages.

In the first three quarters of 2016 alone, howeowners added $837 billion in total equity.

But apparently those gains are not enough to counter the negative effects of rising mortgage rates.

About author

You might also like

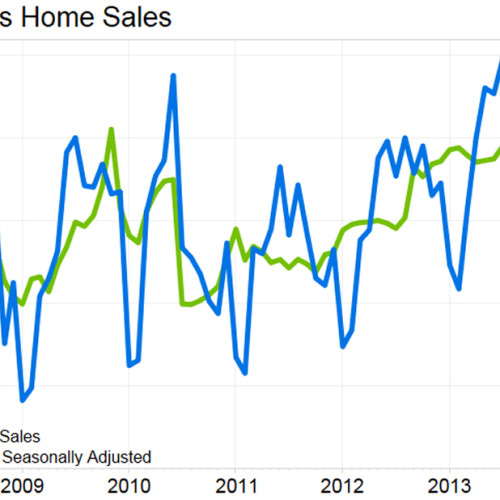

Sluggish Sales Volume

Sales volume for new and existing homes continues to struggle to find upward momentum. With investors leaving the market in the face of high prices and “normal” buyers still struggling

Housing Industry Poised For More Growth In 2017

IRVINE, CA—A number of factors pull in this sector’s direction, such as jobs, household formations and a lack of supply supported by the demographics of Millennials and Baby Boomers, TRI

OC Leads Southern California in Housing Market Health

Among the six Southern California counties, Orange County seems to be in the lead in overall housing market health. The median price of a home in the county was at