Economist Warns That Buyers Face Increasing Troubles

CNBC

By Diana Olick

From a broad view, the U.S. housing market looks very healthy. Demand is high, employment and wages are growing, and mortgage rates are low. But the nation’s housing market is assuredly unhealthy; in fact, it is increasingly mismatched with today’s buyers. While the big numbers don’t lie, they don’t tell the real truth about the affordability and availability of U.S. housing for the bulk of would-be buyers.

About author

You might also like

Housing Starts and Building Permits Exhibit New Found Strength

Total housing starts jumped 20.2% from March to April to hit an annualized pace of 1.14 million with single-family starts jumping by 16.7% to 733,000. Building permits rose 10.1% from

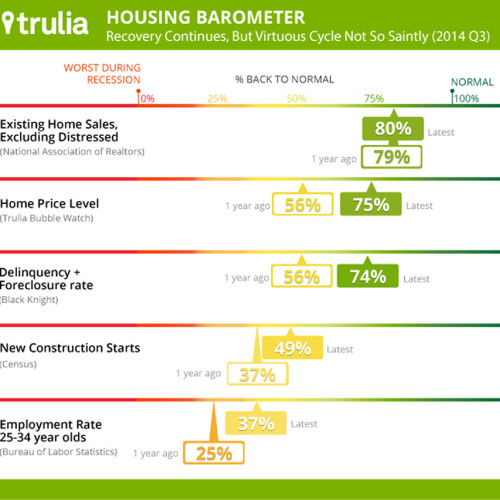

Status of Recovery?

In this snapshot of where we are on the road towards a “normalized” housing market, Trulia chief economist Jed Kolko examines five key factors that impact the market. Bottom line