Will 3% Mortgages Boost the Housing Market?

Fannie Mae and Freddie Mac, government-sponsored enterprises, detailed guidelines this week to buy loans from lenders made to borrowers at up to a 97% loan-to-value ratio. As a result of this increase in LTV, borrowers will be able to obtain mortgage loans with as low as a 3% down payment under some Fannie and Freddie-backed programs. This move is expected to have its biggest impact on the first-time homebuyer and provide a boost to the moribund housing market.

About author

You might also like

SoCal Caps 2016 With Steady Home Price Growth And Modest Sales Gain

By Andrew LePage Southern California’s housing market closed 2016 with the highest median sale price in nine years, continued steady price growth, slightly higher full-year sales than in 2015, record

Millennials Want to Own Homes Too, If U.S. Economy Would Consent

Kelsey Marshall and her boyfriend Chris Eidam, both 27 years old, call the home-buying process “terrifying.” But they’re clear about one thing: It beats the heck out of renting.

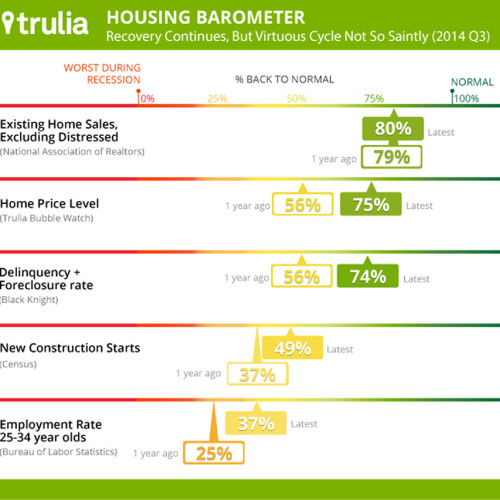

Status of Recovery?

In this snapshot of where we are on the road towards a “normalized” housing market, Trulia chief economist Jed Kolko examines five key factors that impact the market. Bottom line