Land Financing 101

Mark Strauss, Managing Director with Cohen Financial, discusses the nuances of land loans. Due to its illiquid nature and lack of cashflow, lenders are generally hesitant to lend on land assets. If they do, there is a preference for infill versus greenfield and entitled land where the borrower is implementing a business plan that entails build-out of the asset. LTVs tend to stay low – in the 50% to 60% range – with banks charging 4% to 6% interest rates and private money lenders charging 8% to 14%.

About author

You might also like

Harridge Picks-Up Northridge Site

Prolific LA Developer, Harridge Development Group, picks up a 3.3-acre site in Northridge. Led by David Schwartzman, Harridge has become one of the leading developers of in-fill projects in the

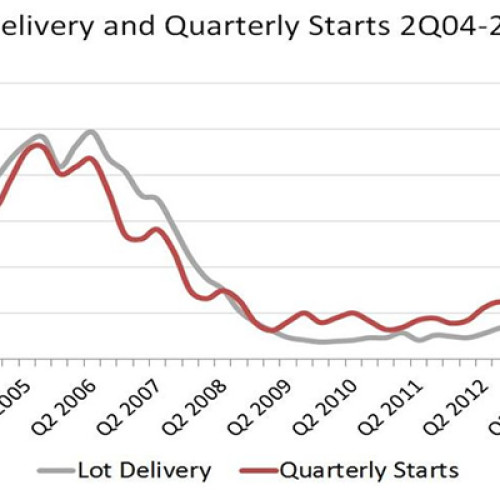

Lot Production on Upward Trend

In the depths of the housing cycle, lot production nationwide was virtually nonexistent. As the housing recovery progresses, the finished lot creation machine seeks to keep up with builder housing

California’s Marblehead Project Down to Four Finalists

The California Marblehead Project in San Clemente is managed by Lehman Brothers Holdings Inc. and formerly controlled by Suncal. The San Clemente site is one of OC’s last remaining stretches